c1000

THIS SITE WILL BE FULLY OPERATIONAL 11/20

You can now reach the FRENCH VERSION at

today's ECONOMICS AND FINANCE

|

| A new method to learn quickly the basics of economics and finance. The basics, no more, no less. Enough to be able to discuss on an equal footing with finance people and bankers. Enough to discover the pleasure of following daily news and feel the progress! |

|

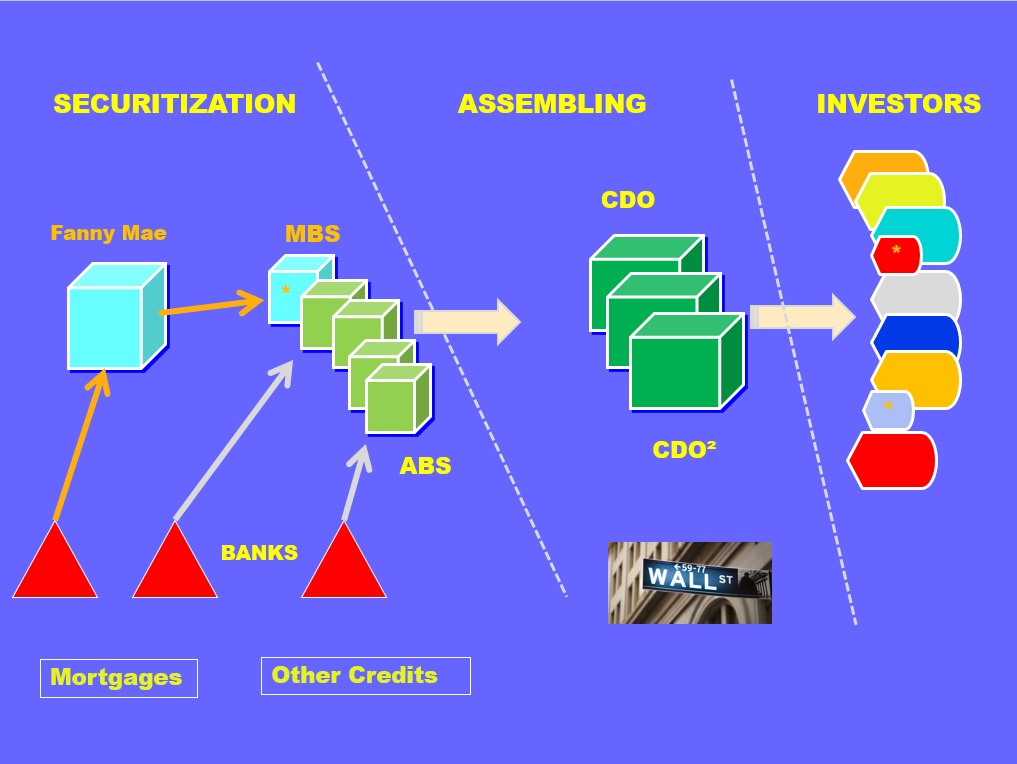

Let's start with an example. The picture below represents the subprimes chain. It should be read from left to right. It shows how credits issued by banks are first transformed into securities (ABS Assets Based Securities and MBS Mortgage Based Securities) that are further assembled and transformed into obligations (CDO Collateralized Debt Obligations), that are then sold to investors. |

|

This may look complex, but it is not. Surprisingly enough, a few basic notions allow the easy understanding of this picture.

The subprime chain is particularly interesting from a learning point of view as it shows how different worlds connect together: the micro-world of bank credit is linked to the macro-world of markets. To put it differently, the recycling of world savings into the banking system allows more credits to be distributed by banks to the economy.. This is where the notion of funds, hedge funds and investment banks appears, as a kind of go-betweens between banks and markets.

The good news are that no more than one hour is needed to understand the logics of the subprimes chain,. No specific knowledge is required. It is thus particularly motivating for non-finance people to be able to break the wall of the finance world and its alleged complexity. |

BASIC NOTIONS

| FINANCE | BANKING | MARKETS |

HOW IT WORKS

| CREDIT | STOCK EXCHANGE | ECONOMICS |

|

How to negotiate bank credits |

FUNDS, leverage tools |

Austerity, supply vs demand policy |

TODAY'S IMPORTANT TOPICS

| BCE | WALL STREET | €URO |

|

Negative interest rates, |

Subprimes, shadow banking |

The strenghts of euro, eurobonds |

|

|

MAJ

sept 2020

(clic)

(clic)