securitization

|

This Excerpt from the course Shows that it is possible to understand in a few minutes one of the most mysterious and useful mechanisms of modern finance. If you have no accounting knowledge, read the first First part Devoted to the principle. |

|

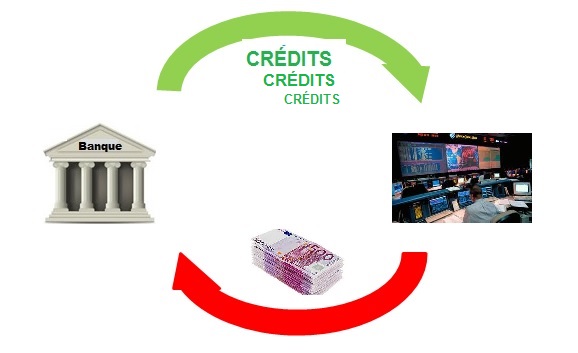

Summary: The securitisation mechanism is very simple. What requires a little more explanation is why this mechanism is important for banks and what is its role in the world of finance and markets Banks, through securitization, can sell existing credits against a cash payment. They use it to alleviate their balance sheet, for example, or change their marketing policy by lending to new categories of borrowers without extending their balance sheet. Markets are fond of the possibility of investing in "packages" of credits from specific sectors and bringing together hundreds or thousands of different borrowers. At the macro level, if there was one thing to remember, it would be this: securitization makes it possible the channeling of non-bank savings to credit. The non-banking savings is the money circulating in what is generally called markets, securitization allows So More In the direction of companies and consumers. More than what banks can do because they are limited by many security barriers. Why more? Thanks to the cash that is paid to them, they can make new credits,... they resell (with a profit of course)... and re-lend... and start again.

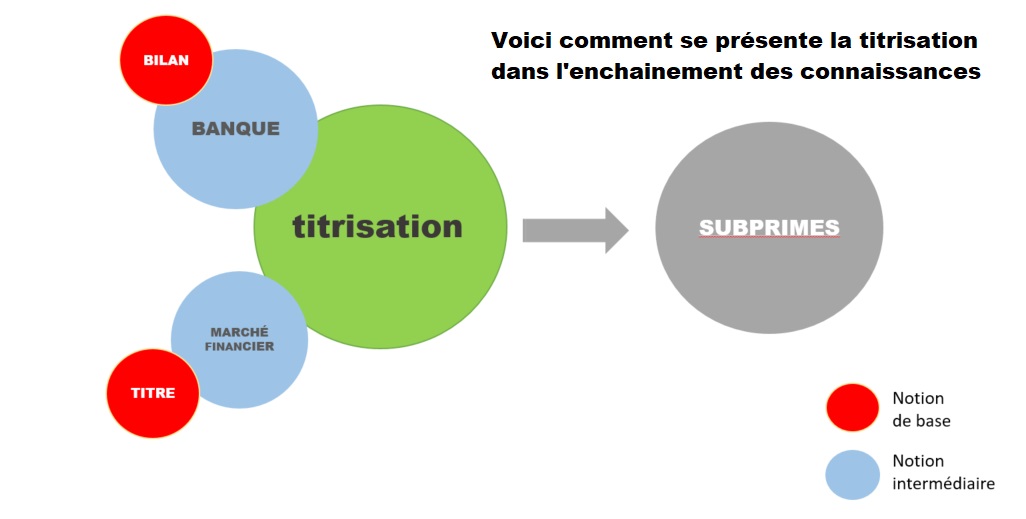

Incidentally, securitization exists in the United States since... 1934. Five years after the crisis that had caused them to suffer heavy losses, the banks were still fragile and struggling to lend to businesses. The securitization of the existing appropriations enabled them to recover cash and to make new credits. Without any change for the current borrowers. Securitization is an important key for capturing the importance of financial markets. It also helps to understand what really happened in the subprime crisis. And also why the ECB referred to its use in September 2014.

Giving responsibility for the subprime crisis to securitization has no more sense than... blaming the airplane for the responsibility of air disasters. |

Access to basic concepts/intermediate concepts

is proposed at the end of the module or

|

Definition and principle |

|

|

Advantage for banks |

|

|

Advantage for investors |

|

|

Calculation The price of a credit |

|

|

Macro-economic perspective |

|

| |

A step further |

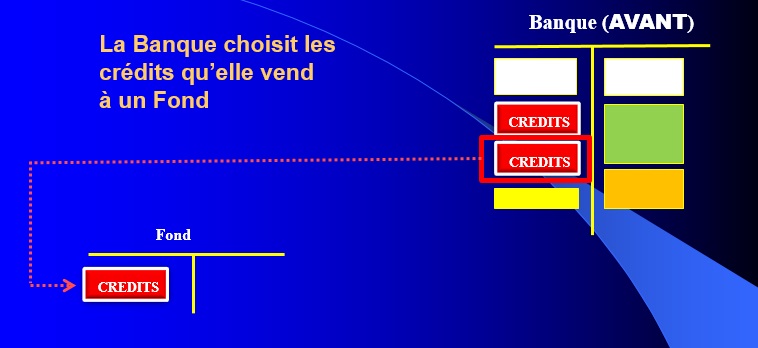

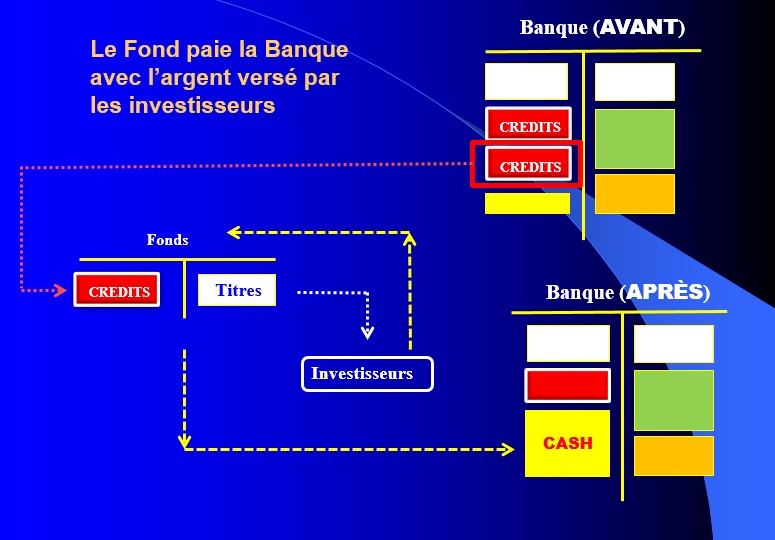

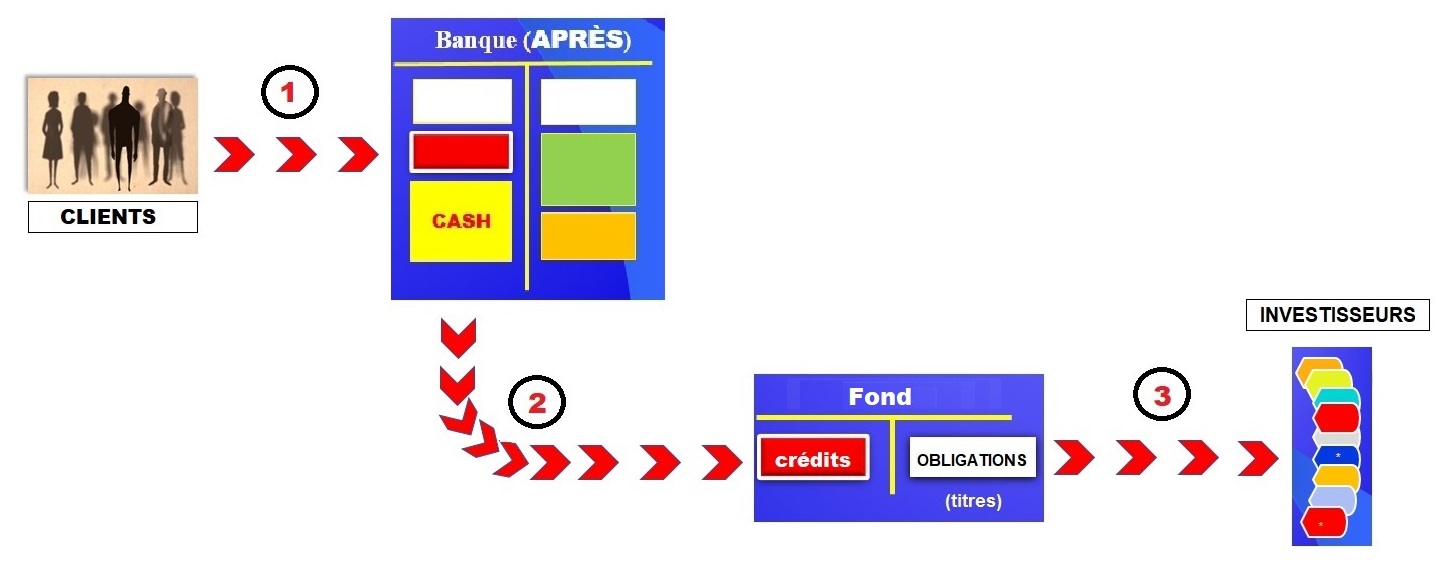

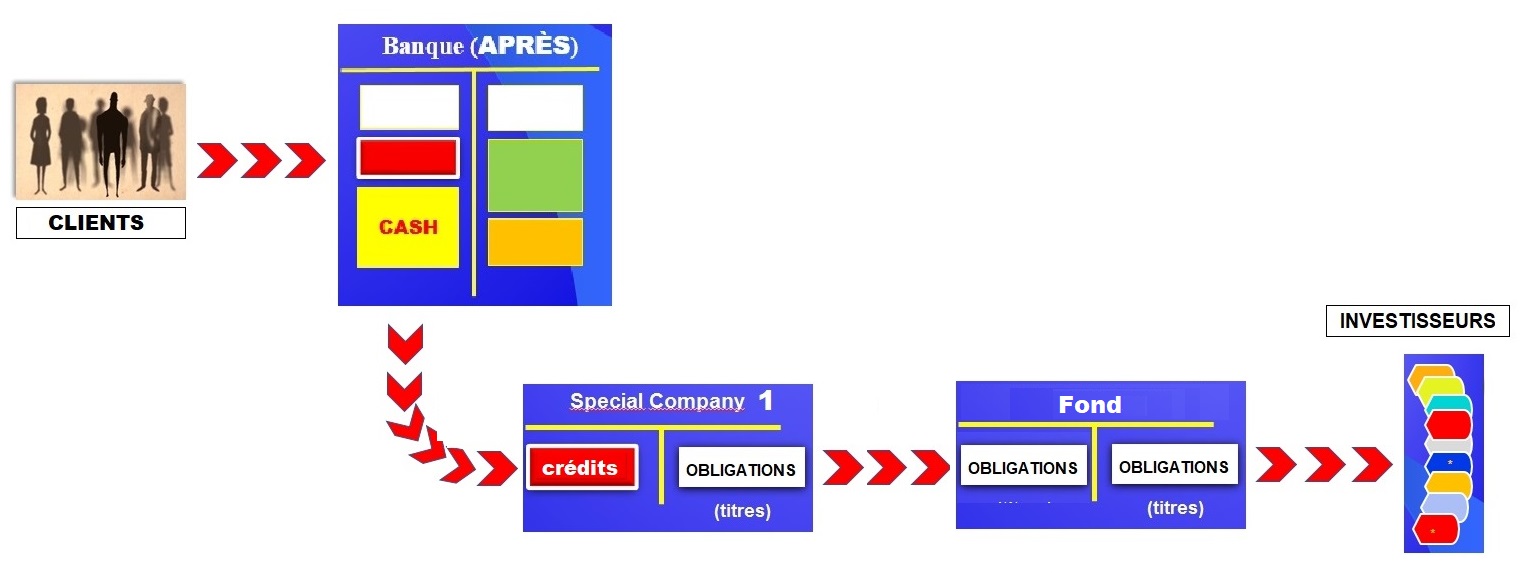

The notion of securitization Actually covers two separate but overlapping mechanisms.

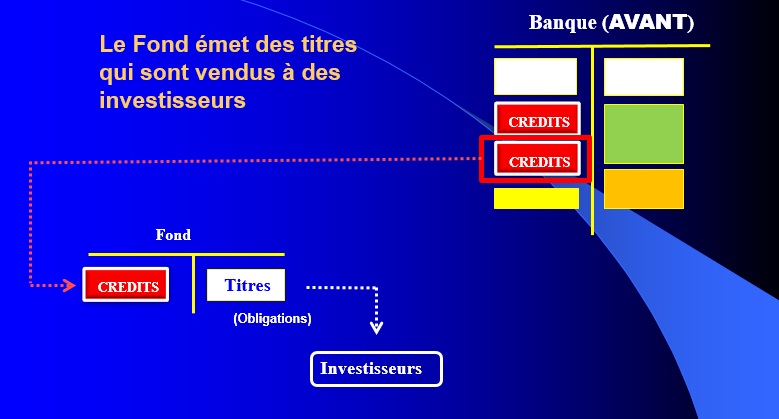

It is first of all the sale by a bank of some of its credits to a specialized agency, for example a fund. It is then the creation by this body of "securities" backed by these appropriations. These securities, similar to bonds, are then sold to "investors", funds or private investors. Their performance and level of risk are of course directly related to the credits they are leaning on.

In English jargon, these titles are called Securities.

Les schémas explicatifs qui suivent montrent le mécanisme de la titrisation.

L'explication s'appuie sur une représentation imagée du bilan, d'ailleurs utilisée dans l'ensemble du cours, avec des rectangles colorés et de tailles différentes.

A noter que les bases du langage comptable font l'objet d'un module spécifique du cours, mais ici, pas besoin de connaissances comptables pour comprendre.

Ces rectangles colorés correspondent aux postes les plus importants. Ainsi, les crédits distribués par la banque s'inscrivent en rouge, tout comme ses réserves en cash (jaune). Les dépôts des clients sont représentés en orange et les emprunts de la banque en vert. Une petite explication sur ces emprunts de la banque: il s'agit d'emprunts auprès d'autres banques, auprès de la banque centrale ou sur le marché obligataire. Pour faire simple: les banques prêtent plus que les dépots de la clientèle. Le plus provient de ces emprunts.

Ce qui est important est de suivre l'évolution des surfaces de ces rectangles dans les différentes étapes de la titrisation.

ÉTAPE 1

ÉTAPE 2

ÉTAPE 3

Le fond encaisse les mensualités et fait ensuite son affaire de distribuer ces "revenus" aux acheteurs d'obligations en intérêt et en capital, selon les modalités des obligations.

A noter que dans ce dernier exemple, le Fond "fabrique" de nouvelles obligations en mélangeant des obligations achetées à des Special Company.

Principle

The sequence

The following explanatory schemes show the mechanism of securitization.

The explanation is based on a pictorial representation of the balance sheet, also used throughout the course, with colorful rectangles and different sizes.

Note that the basics of accounting language are the subject of a specific module of the course, but here No need for accounting knowledge To understand.

These colorful rectangles correspond to the most important positions. Thus, the credits distributed by the Bank are registered in red, as are its reserves in cash (yellow). The deposits of the customers are represented in orange and the loans of the bank in green. A small explanation on these loans from the bank: they are borrowing from other banks, from the central bank or on the bond market. To make it simple: banks lend more than customer deposits. The most comes from these loans.

What is important is to follow the evolution of the surfaces of these rectangles in the different stages of securitization.

Step 1

Step 2

Step 3

Point of view of the borrower

For the borrower, the bank's initial customer, Nothing changes In fact:

The customer continues to pay his credit payments to the bank, under the terms of the original credit agreement, which is not changed.

The bank immediately transferred the credit payments to the fund which purchased the "package" of credits. The bank has therefore become a mere intermediary and is therefore not concerned by the potential default of the borrower. Why then keep the bank in the circuit? To not have to change one by one the thousands of securitized credit contracts.

![]()

The fund collects the monthly payments and then proceeds to distribute these "revenues" to the buyers of bonds in interest and capital, according to the terms of the bonds.

Note that the name of the Background is reserved for the company that is at the end of the chain, and whose bonds will be bought by the investors. Intermediate structures are called Sc (Special Company), Sic (Special investment Company) or Siv (Special investment Vehicle).

Note that in this last example, the fund "manufactures" new bonds by mixing bonds purchased from special Company.

Advantage for banks

For banks, the rationale for securitization is not to "get rid" of bad credits, as has sometimes been commented on in the context of Subprime. A strange interpretation, because one might ask who would want to buy bad credits.

The motivations of banks to give up some of their credits are multiple.

- The main Reduce their outstanding - i.e. the volume of these credits -With regard to the regulatory constraints imposing a certain level of equity in relation to the appropriations granted. If the equity falls, after losses for example, the bank must reduce its commitments to meet the taxed ratios. For this it will sell part of its credits to a third party, a bank or... a securitisation structure. For the bank's clients who have benefited from these credits, nothing changes. The bank continues to collect refunds and then returns it to the securitisation structure.

- Another equally important reason is the concern Change Portfolio risk profile of credits. In the latter case, the bank sells the credits of a given economic sector and redistributes new credits in another sector.

- The third reason seems to contradict the first one: by easing the balance sheet of the banks, securitization gives them the opportunity to Lend more. How? Simply by securitizing each new credit, which does not increase their outstanding and therefore does not change the prudential balances.

- It is therefore not surprising that in Europe we seek to Develop securitization, "We" are essentially the ECB. What motivates the ECB is to increase the volume of appropriations in the service of the economy limestone the banks ' limits.

What also motivates the bank in lending more is the prospect of earning more. In fact, it collects a margin on each credit sold to the securitisation structure. We will see in the chapter on decryption of financial calculations how this margin is calculated and how in the case of Subprime, she was able to reach incredibly high levels.

For those who are comfortable with the actuarial calculation, the selling price of a credit is the present value of future payments. The lower the discount rate, the stronger the present value. It is enough to resell a credit at an interest rate lower than the rate the borrower knows to achieve a large margin: more than 7% margin for example for a 25-year credit resold with a interest differential of 1%. The bank that yields a credit of 100 000 euros under these conditions touches 107 000 euros!

Securitization therefore gives banks a Immense flexibility In the management of their credits, what the following diagram sums up:

Advantage for investors

The interest of securitization for banks is considerable, as it offers them new possibilities of managing their business.

For investors securitization is equally important as it gives them a flexibility factor. It is a brand new investment area that is available to them. It is indeed for them the possibility to choose precisely where they want to invest.

Who are these Investors ? All the institutions of France and elsewhere that have lasting or occasional money to place. Private or public Institutions, these investors could put that money in the banks. Many prefer to make stock market investments, buy bonds, take equity in companies. Or simply entrust their money to specialized organizations that will make investments on their behalf.

We find insurance companies, pension funds, sovereign states with surpluses, investment funds, etc...

The total financial capacity of investors is estimated at 72 $0 ! This astronomical figure explains the motivation of business banks proposing investment solutions.

Securitization allows to offer new "securities" of investment in the financial market. These new titles are bonds combining credits of various origins.

This diversity plays at the level of the borrowers ' categories. It also plays at the level of the categories of assets financed.

That is exactly what investors want: Choose!

Those with real estate affinities will choose bonds from real estate credits. This will be the way for those who prefer a particular industrial sector or type of goods (planes, cars, boats, etc.).

The choice of a custom investment is therefore possible! And to all these investors, it appears that it is less risky to lend to 100 or 1000 borrowers, rather than to a single one.

We understand the rush of business banks, downstream of securitization. They have exercised all their talents to diversify to the maximum possible choices.

Calculation: Selling price of a credit

The technique Actuarial is used to calculate the price of a credit. But not everyone has the "mathy" spirit and more than the formulas, it is interesting to look at what we can call theMind Calculus, his philosophy.

Let's take theExample A bank that has just granted a credit to a customer. So she paid him the corresponding money. In return, it will receive a series of financial flows (monthly payments) calculated at the contract rate.

The next day she decides to sell this credit to a third party. She's not going to do it "for free," but instead strive to make a profit.

How to do it, Knowing that it can no longer change the conditions granted to the customer?

This one, moreover, is often unaware that the bank has surrendered its credit. From the beginning to the end of the credit, he pays the same monthly payments to the original bank, which the latter discreetly reverses to the organization that buys the credit.

In fact, if the seller bank cannot change the contract terms, it will "play" with the selling price. .... which amounts to changing the interest rate of the transaction from the point of view of the credit purchaser.

We can Intuitively understand.

Let's take a one year credit of 100 with a rate of 10%. The buyer buys it 105, but will collect the original monthly payments. Reported at 100, profitability was 10%, but the same monthly payments reported to 105 reduce profitability to say 9%.

In this case, the selling bank has made an immediate profit of 5. For its part, the purchasing bank has done a financial transaction that will bring it 9%. She can find her... interest. In practice all of this is obviously negotiated harshly.

It should be noted that if the bank were to sell credit 90, it would make a loss of 10, and the purchaser bank would do an operation that would cost 11% or more.

"Real numbers" make you dizzy as soon as the durations are long.

The actuarial calculation shows that a 10-year obligation at the 2% facial rate sold at the rate of 1% results in a 9% gain in the seller's books. If the redemption rate is 0.25%, this double value is 18%.

This is exactly the Mechanism used by the ECB To discreetly bail out the eurozone banks and strengthen their own funds. A policy called Quantitative Easing (anAlly on the "negative rates" tab in the right column).

Note that in technical terms, the price is the current value of a flow sequence, updated with a given rate. So there are as many prices as there are rates. There are four parameters: duration, rate and price and monthly payment. The knowledge of three of them allows to know the fourth.

For those interested, you can easily find formulas in Excel (financial functions) and make results tables showing the sensitivity of one of the parameters according to the other three.

Economic utility A topical topic

A Little history Securitization was invented in the United States in 1934, in the context of the New Deal, under Roosevelt. The problem posed then was the revival of the economy after the disaster of the crisis of 1929. The banks, which were badly affected by the crisis, could not provide the necessary appropriations, as a result of the losses suffered. Yet there were resources available. Securitization has enabled these resources to be collected to finance the economy's appropriations without charging the bank's balance sheet.

Securitization is a means of Develop the credit without loading the banks.

We have to see this point: securitization leads to a Profound change Of the financing of credit, which passes from banks to the market, even if the banks remain the places where the credits are created.

Securitization Carries the credit risk outside the banking sphere. Securitized appropriations are financed by the markets, i.e. by the savings of investors.

This possibility of financing credit outside the banking circuits is particularly sought when banks are struggling to do their job because of lack of sufficient own funds, and also because there are risks that banks can Not take because they would endanger the deposits of their customers.

In Europe, the revival of the European economy since the 2008 crisis imposed the development of business credit. However, the banks had reached their credit limits, due to the losses suffered which diminished their own funds and the provisions of Basel III which impose on the contrary to increase the own funds for a given level of credit.

The ECB has solved the problem with the so-called Quantitative easing, which has brought to the banks very cheap resources.

Developing European markets

With securitization, things would have been easier, but the subject remains nonethelessNews. The ECB and the European financial authorities are in favour of its development because this is the way to develop markets in Europe. The European lag in this area, which is considerable, is illustrated by the following schemes:

Why this importance? Because, for example, many European start-ups can't grow up really because of a lack of sufficient investors. If the GAFA (Google, Amazon, Facebook...) were able to grow as they did, it is mainly thanks to the highly developed financial markets in the United States.

It is understandable why, in this context, the ECB Officially launched the subject of securitization from 2014.

|

To go further Without perhaps having understood everything, you have certainly grasped the bulk of securitization, that is, its principle.

This topic is discussed twice in the course. The first time to show the importance of the Notion of title, a rather intuitive notion that is the basis of the understanding of markets. A second time, towards the end of the course, because the in-depth analysis of the securitisation allows a synthesis of knowledge in the field of the bank and the markets. Securitization makes it possible to take the path of Crisis of Subprime. An exciting path on an educational level, because it is an opportunity to discover the astonishing creativity of the business bankers...

|

|

Have in mind the structure of the Balances (company and Bank) Digging up the operation of Banks and financial markets |

-O-O-o-O-

See more excerpts: (click image)

May 15/01/2018